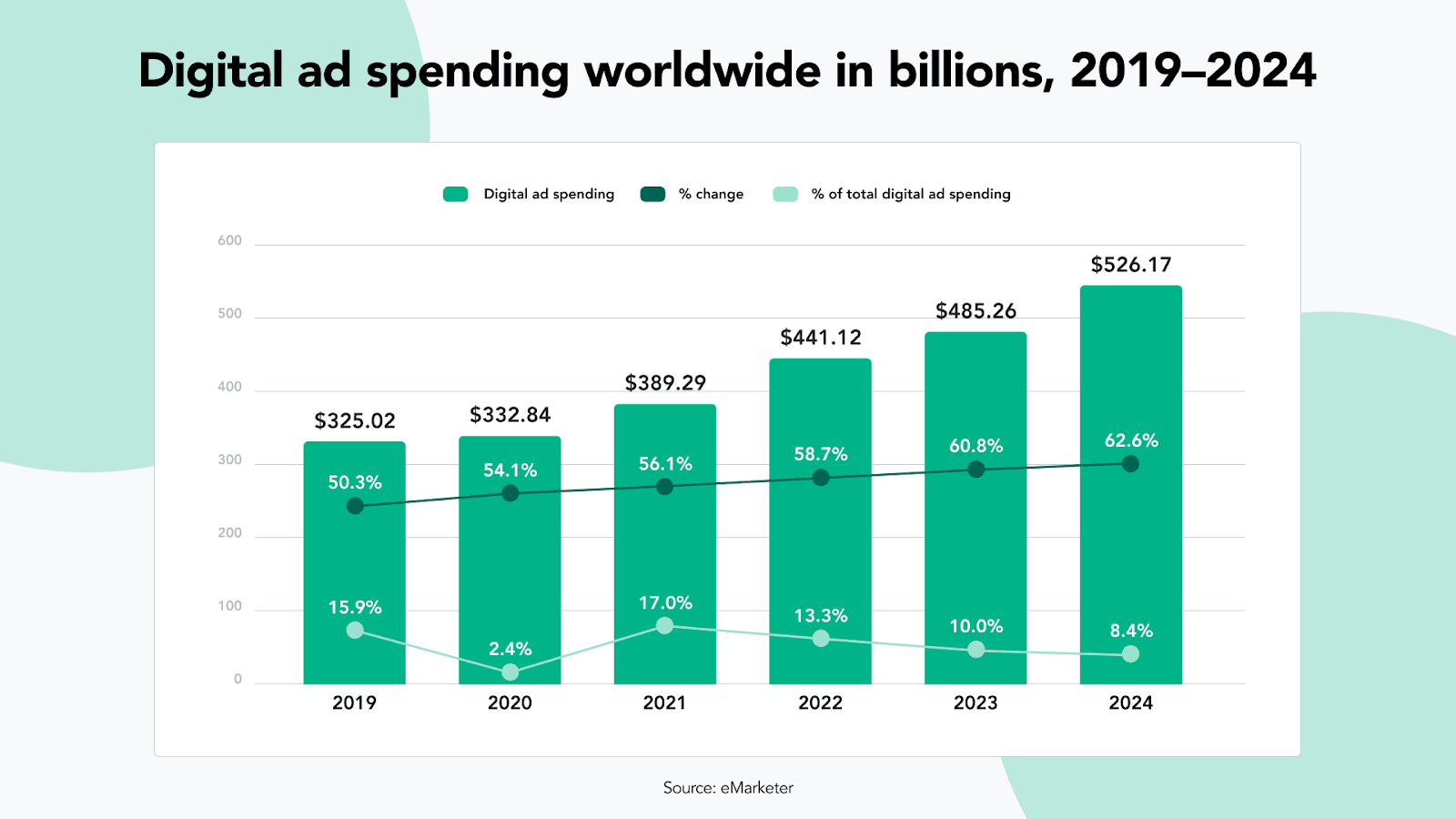

Are you investing in digital marketing efforts without knowing if you’re getting a solid return on investment (ROI)? Many businesses make this mistake, focusing on acquiring customers without fully understanding the cost involved. That’s where calculating the Customer Acquisition Cost (CAC) becomes crucial. By accurately determining how much it costs your business to acquire a customer, you can make smarter decisions about where to allocate your digital marketing budget. In this article, we will explore the importance of calculating CAC in digital marketing and how it can help you maximize your ROI. From optimizing your advertising campaigns to identifying the most cost-effective channels, understanding your CAC provides valuable insights that can drive your business growth. Join us as we delve into the world of customer acquisition cost and discover the power of data-driven decision making in your digital marketing strategy.

Understanding customer acquisition cost (CAC)

Customer acquisition cost (CAC) is the total cost of acquiring a new customer. This includes all the expenses incurred to attract and convert a lead into a customer. CAC is an essential metric for businesses because it helps them determine the effectiveness of their marketing and sales efforts. By knowing how much it costs to acquire a new customer, businesses can make informed decisions about how much they should spend on marketing and which channels to focus on.

Calculating CAC involves taking all the costs associated with acquiring a new customer and dividing it by the number of customers acquired in that period. It’s important to note that CAC is not a fixed cost and can fluctuate based on various factors, such as the marketing channel used, the target audience, and the industry.

Why calculating CAC is important for digital marketing

Calculating CAC is crucial for digital marketing because it allows businesses to determine which channels and campaigns are the most cost-effective. By understanding how much it costs to acquire a customer through each channel, businesses can allocate their budget more efficiently and optimize their marketing efforts to increase their ROI.

For example, if a business is spending a significant amount of money on Facebook advertising, but the CAC is high, they may need to re-evaluate their strategy. On the other hand, if a business is getting a high conversion rate from a low-cost email marketing campaign, they may want to invest more in that channel.

Factors influencing CAC

Several factors can influence CAC, including the type of industry, target market, and marketing channels used. In highly competitive industries, where many businesses are vying for the same customers, the CAC can be higher. Similarly, targeting a niche audience can also increase the CAC because it can be more challenging to reach and convert them.

The marketing channels used can also significantly impact CAC. Channels that have higher costs per click, such as search engine marketing (SEM), can result in a higher CAC compared to channels that have lower costs, such as email marketing or social media advertising.

Calculating CAC: The formula and metrics to consider

Calculating CAC involves taking all the costs associated with acquiring a new customer and dividing it by the number of customers acquired in that period. The formula for calculating CAC is as follows:

CAC = Total cost of sales and marketing / Number of new customers acquired

To accurately calculate CAC, businesses need to consider all the costs associated with acquiring a new customer, including advertising expenses, salaries, commissions, and overhead costs. It’s also essential to track the number of customers acquired in a specific period, such as a month or quarter.

Another metric to consider when calculating CAC is the Customer Lifetime Value (CLV). CLV is the total amount of revenue a customer is expected to generate for the business over their lifetime. By comparing CAC to CLV, businesses can determine if their marketing efforts are profitable in the long run.

The relationship between CAC and ROI

The relationship between CAC and ROI is straightforward: the lower the CAC, the higher the ROI. When businesses can acquire customers at a lower cost, they can generate more revenue from each customer, resulting in a higher ROI. Conversely, if the CAC is high, it can eat into the profits generated from each customer, resulting in a lower ROI.

By understanding the relationship between CAC and ROI, businesses can optimize their marketing efforts to maximize their ROI. This may involve focusing on high-converting channels or re-evaluating their targeting strategy to reach a more cost-effective audience.

How to reduce CAC and increase ROI

Reducing CAC is crucial for increasing ROI. Here are some strategies businesses can use to reduce CAC and increase their ROI:

1. Improve targeting

Focusing on a more specific audience can help reduce CAC. By understanding the needs and pain points of their target audience, businesses can create more targeted campaigns that resonate with them and increase the chances of converting them into customers.

2. Optimize landing pages

Optimizing landing pages can also help reduce CAC. By creating landing pages that are tailored to the campaign and have a clear call-to-action, businesses can increase the chances of converting leads into customers.

3. Experiment with different channels

Experimenting with different marketing channels can help businesses find the most cost-effective channels for acquiring customers. This may involve testing different channels, such as social media advertising, email marketing, or search engine marketing, and analyzing the results to identify the most effective channels.

4. Refine the sales process

Refining the sales process can also help reduce CAC. By streamlining the sales process and addressing any bottlenecks or obstacles, businesses can increase the efficiency of their sales team and reduce the cost of acquiring new customers.

Tools and software for tracking CAC

There are several tools and software available for tracking CAC, including:

1. Google Analytics

Google Analytics is a free tool that allows businesses to track website traffic and conversion rates. By setting up conversion tracking, businesses can track the number of customers acquired through each channel and calculate the CAC.

2. CRM software

CRM software, such as Salesforce or Hubspot, can also help businesses track CAC. By storing customer data and tracking sales and marketing activities, businesses can calculate CAC and identify opportunities for optimization.

3. Marketing automation software

Marketing automation software, such as Marketo or Pardot, can help businesses automate their marketing and sales activities and track the ROI of each campaign. By analyzing the data, businesses can identify the most cost-effective channels and optimize their marketing efforts.

Case studies: Successful strategies for optimizing CAC

Here are some case studies of businesses that have successfully optimized their CAC:

1. Dropbox

Dropbox reduced its CAC by offering a referral program that rewarded existing customers for referring new customers. The program was highly successful, resulting in a 60% increase in sign-ups and a 10% reduction in the CAC.

2. Zappos

Zappos reduced its CAC by offering free shipping and returns, which encouraged more customers to make a purchase. This resulted in a 25% increase in sales and a 50% reduction in the CAC.

3. Airbnb

Airbnb optimized its CAC by using targeted advertising to reach a more specific audience. By focusing on travelers who were interested in unique and affordable accommodation options, Airbnb was able to reduce its CAC by 23%.

Common mistakes to avoid when calculating CAC

When calculating CAC, businesses should avoid the following common mistakes:

1. Not considering all costs

To accurately calculate CAC, businesses need to consider all the costs associated with acquiring a new customer, including overhead costs and salaries. Failing to consider all costs can result in an inaccurate CAC calculation.

2. Not tracking conversions

To calculate CAC, businesses need to track the number of customers acquired in a specific period. Failing to track conversions can result in an inaccurate CAC calculation.

3. Not comparing CAC to CLV

To determine the profitability of marketing efforts, businesses need to compare CAC to CLV. Failing to consider CLV can result in a skewed view of the effectiveness of marketing efforts.

Conclusion: Leveraging CAC to drive business growth

Calculating CAC is crucial for businesses that want to maximize their ROI and drive business growth. By understanding how much it costs to acquire a customer through each channel, businesses can optimize their marketing efforts and reduce their CAC. This may involve improving targeting, optimizing landing pages, experimenting with different channels, and refining the sales process. By tracking CAC and comparing it to CLV, businesses can make informed decisions about how much they should spend on marketing and which channels to focus on. By leveraging the power of data-driven decision making, businesses can drive growth and achieve their marketing and sales goals.